As part of the NSW Government's commitment to a strong and sustainable local government system, a new planning and reporting framework for NSW local government has been introduced.

These reforms replace the former Management Plan and Social Plan with an integrated framework. It also includes a new requirement to prepare a long-term Community Strategic Plan and Resourcing Strategy.

The specific aims of the Integrated Planning and Reporting framework are to:

- Improved integration of various statutory planning and reporting processes undertaken by Councils as required by the Local Government Act 1993, the Department's Guidelines and the Environmental Planning & Assessment Act 1979

- Strengthen Council's strategic focus

- Streamline reporting processes

- Ensure that the Local Government Act 1993 and the Integrated Planning and Reporting Guidelines support a strategic and integrated approach to planning and reporting by local Councils

The new framework opens the way for Councils and their communities to have important discussions about funding priorities, service levels and preserving local identity and to plan in partnership for a more sustainable future.

Goulburn Mulwaree Council's Operational Plan 2025 - 2026 was adopted by Council at their Meeting held on 17 June 2025.

A copy of the Delivery Program 2025-2029 and the Operational Plan 2025-2026 along with the accompanying Appendices (including Fees & Charges) can be downloaded using the links below. The documents include details of the rating structure and pricing policy, including fees and charges and a statement containing a detailed estimate of Council's income and expenditure for the 2025-2026 financial year.

Delivery Program 2025-2029 (PDF, 1MB)

Operational Plan 2025-2026(PDF, 764KB)

Appendices 2025-2026 (includes Fees & Charges at Appendix D)(PDF, 8MB)

For further information please contact Councils Corporate & Community Services Directorate on 4823 4552 or email debbie.mccarthy@goulburn.nsw.gov.au

The Annual Report is one of the key points of accountability between a Council and its community.

It is not a report to the Office of Local Government or the NSW Government, it is a report to the Community.

The Annual Report focuses on Council's implementation of the Delivery Program and Operational Plan because these are the plans that are wholly the Council's responsibility.

The Annual Report and Audited Financial Statements can be downloaded using the links below.

GMC Annual Report 2024-2025(PDF, 14MB)

2024-2025 Audited Financial Statements(PDF, 4MB)

GMC Annual Report 2023-2024(PDF, 4MB)

2023-2024 Audited Financial Statements(PDF, 3MB)

GMC Annual Report 2022-2023(PDF, 4MB)

2022-2023 Audited Financial Statements(PDF, 5MB)

In accordance with Section 482(2) of the Local Government Act 1993 and the requirements of the Integrated Planning and Reporting Legislation and Guidelines (Office of Local Government) a State of our Region Report is required detailing Council’s progress in implementing the Community Strategic Plan (CSP) during its term. The focus of this report is on initiatives that Council has direct influence over and utilises a range of performance and assessment methods identified in its Community Strategy Plan and Integrated Planning documents.

We are pleased to present the Goulburn Mulwaree Council’s State of Our Region Report for 2021-2024. A copy can be downloaded using the link below:

State of Our Region Report(PDF, 1MB)

The Resourcing Strategy consists of three components:

- Long Term Financial Planning

- Workforce Management Planning

- Asset Management Planning

The Resourcing Strategy is the point where Council assists the community by sorting out who is responsible for what, in terms of the issues identified in the Community Strategic Plan. Some issues will clearly be the responsibility of Council, some will be the responsibility of other levels of government and some will rely on input from community groups or individuals.

The Resourcing Strategy Documents can be downloaded using the links below:

Long Term Financial Plan 2025-2026 to 2034-2025(PDF, 472KB)

Workforce Management Plan 2025-2029(PDF, 1MB)

Strategic Asset Management Plan November 2023(PDF, 6MB)

The Community Strategic Plan is the highest level of strategic planning under the framework and sets a vision and strategic priorities for each of the Councils. All other plans developed by the Council as part of the Integrated Planning and Reporting framework must reflect and support the implementation of the Community Strategic Plan.

The purpose of the plan is to identify the community's main priorities and aspirations for the future and to plan strategies for achieving these goals. In doing this, the planning process will consider the issues and pressures that may affect the community and the level of resources that will realistically be available to achieve its aims and aspirations. While a Council has a custodial role in initiating, preparing and maintaining the Community Strategic Plan on behalf of the local government area, it is not wholly responsible for its implementation. Other partners, such as State agencies and community groups may also be engaged in delivering the long-term objectives of the plan.

In 2021, the Canberra Region Joint Organisation (CRJO) and seven member Councils resolved to collaborate to review their current Community Strategic Plans and apply a regional lens to identify the region's challenges and opportunities. The Regional Community Strategic Plan project was established with an outlook to 2042 and publicly named Towards 2042.

The Regional Community Strategic Plan (RCSP) outlines the aspirations of the region and sets strategies to achieve them. It is split into three sections and each participating Council has a chapter outlining their Community Strategic Plan (CSP). Each CSP is framed by five themes essential to the liveability and prosperity of local communities i.e. Community, Economy, Environment, Infrastructure and Civic Leadership. The participating Council's are: Bega Valley Shire Council, Goulburn Mulwaree Council, Queanbeyan-Palerang, Snowy Monaro, Snowy Valleys, Upper Lachlan and Yass Valley.

The Goulburn Mulwaree Community Strategic Plan 2042_2025 Revision was adopted by Council on 18th March 2025.

A copy of the Regional Community Strategic Plan 2042 and the Goulburn Mulwaree Community Strategic Plan 2042_2025 Revision is available to download using the link below:

CRJO Regional Community Strategic Plan 2042(PDF, 57MB)

Goulburn Mulwaree Community Strategic Plan 2042_2025 Revision (PDF, 30MB)

Cost shifting remains one of the most significant challenges facing the NSW Local Government sector.

The July 2025 Cost Shifting Report has highlighted a total cost shift to councils of $1.5 billion in 2023-24. To read more and download the report, click here.

Council Decision

Following the end of the community consultation process, at its meeting on 21 November 2023 Council resolved to make a three-year SV application to reduce the burden on ratepayers in the short term. Further information on this decision can be downloaded using the link below:

Final Option Selected by Council(PDF, 153KB)

Council Report

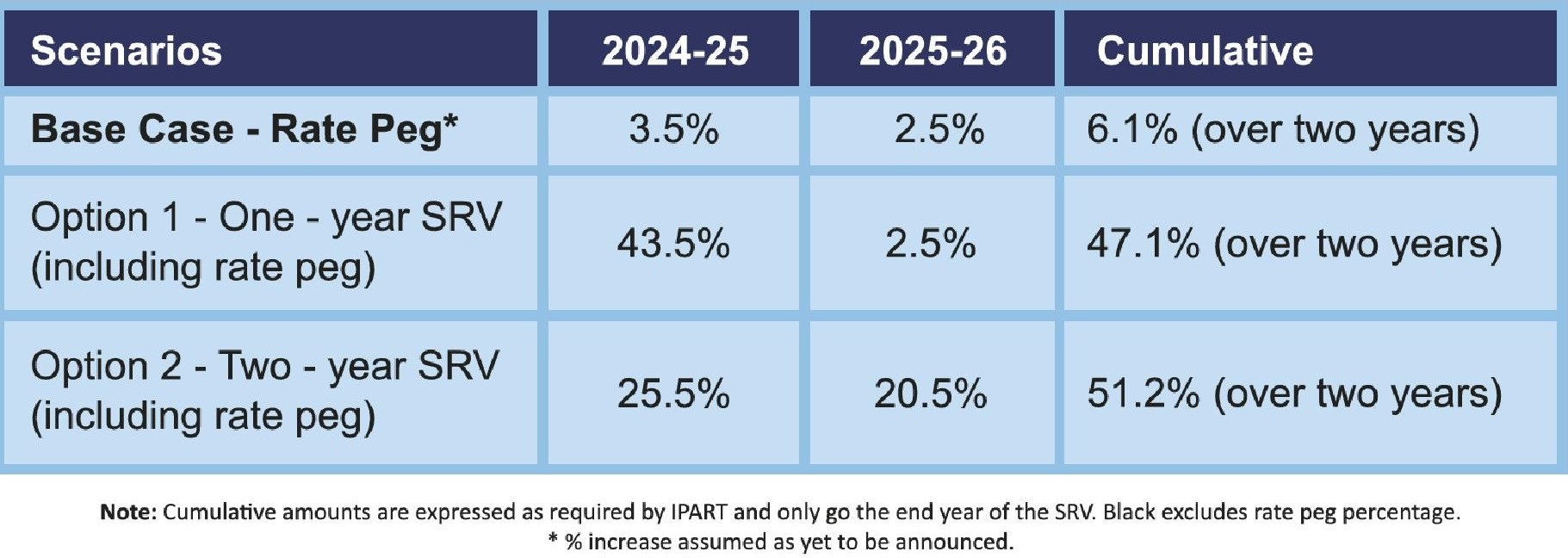

At its meeting held on 19 September 2023, Council endorsed the undertaking of community consultation on a potential application to the Independent Pricing and Regulatory Tribunal (IPART) for a proposed permanent Special Rate Variation (SRV) of either a one year SRV of 43.5% in 2024-25 (including the forecasted rate peg of 3.5 per cent) or a two year SRV of 25.5% in 2024-25 (including the forecasted rate peg of 3.5 per cent) and 20.5 per cent in 2025-26 (including the forecasted rate peg of 2.5 per cent), representing a cumulative Special Rate Variation of 51.2 per cent over two years.

These proposed increases would apply to the minimum rates in Council’s rating structure.

Click here to download a copy of the Council report(PDF, 171KB)

Background Paper

The Goulburn Mulwaree Council (‘Council’) financial position is unsustainable at the current levels of expenditure and income. This has occurred for a number of reasons discussed in this background paper.

Council has made decisions on assets, services and rating options in the best interests of its communities. However, this, when combined with other external influences and legislative restrictions, has gradually led to declining financial sustainability. This is a problem which Council must now address as a matter of urgency.

Council’s 2024-2034 Long Term Financial Plan (LTFP) forecasts consolidated operating deficits to 2034. The General Fund average operating deficit for the 10-year forecast period is estimated at $10.7 million per annum. Ongoing core costs and externally imposed obligations on local governments are outpacing revenue growth and placing council budgets under increasing pressure. Unless current levels of income are increased, Council will be unable to resource renewal of assets and maintain current services. Goulburn Mulwaree Council is not alone, with some 60 NSW councils reported operating deficits in their General Fund in 2021/22.

Please click here to download a copy of the Goulburn Mulwaree Council Background Paper(PDF, 385KB)

Financial Sustainability And Special Rate Variation Assessment

Council has engaged Morrison Low to undertake an independent financial assessment, including an organisational review to identify financial improvements that could improve value for money for ratepayers and minimise any SRV that might be required.

Click here to watch a presentation from Morrison Low on the Goulburn Mulwaree Financial Sustainability - Base Case and SRV Options

Community Newsletter

Council has created a Community Newsletter to help understand how the Special Rate variation will effect them.

Please click here to download a copy of the Community Newsletter(PDF, 370KB)

Long Term Financial Plan

The creation of a Long Term Financial Plan is a requirement under the Integrated Planning and Reporting framework for NSW Local Government and forms part of the Resourcing Strategy.

The Long Term Financial Plan is a 10 year plan that tests the community’s aspirations against its financial capacity. The Long Term Financial Plan will be used as a decision-making tool and is not set in concrete and will continue to evolve and change as circumstances change and Council decisions are implemented.

A Long Term Financial Plan provides a framework for Goulburn Mulwaree Council to assess its revenue building capacity to deliver upon the key performance indicators for all the principal activity areas and provide suitable level of services outlined in the Community Strategic Plan.

The Long Term Financial Plan also aims to:

- Establish greater transparency and accountability of Council to the community;

- Provide an opportunity for early identification of financial issues and any likely impacts in the longer term;

- Provide a mechanism to solve financial problems and understand the financial impact of Council decisions; and

- Provide a means of measuring Council’s success in implementing strategies.

To download a copy of the Long Term Financial Plan click here(PDF, 14MB)

Goulburn Mulwaree Improvement Plan – 2023

Goulburn Mulwaree Council (‘Council’) has identified that the council is facing challenges that place its financial sustainability at risk. Therefore, Council has undertaken an organisational sustainability review to identify financial and operational opportunities that can guide Council through the development of an improvement plan, outlining productivity gains, cost savings, increased income and/or additional resource needs for long-term operational sustainability. This sustainability review may also be used to form one of the key elements to support a potential special rate variation (SRV) application to the NSW Independent Pricing and Regulatory Tribunal (IPART), to be implemented from 1 July 2024.

Please click here to download a copy of the Goulburn Mulwaree Improvement Plan(PDF, 8MB)

Special Rate Variation Community Engagement Plan

The purpose of this community engagement is to ensure that the community is adequately informed and

consulted about the impact of the proposed special rate variation and the impact of not applying for a special rate variation.

The objectives of this community engagement process include:

- to present the proposed SRV

- to identify the impact of the SRV on the average and minimum rates across each rating category

- to communicate to the community the timeline and process for any potential SRV application

- to gather and consider the community’s feedback to inform Council’s final decision on whether to move forward with an SRV application.

Please click here to download a copy of the Community Engagement Plan(PDF, 1MB)

Council’s Special Rate Variation Community Drop-in Schedule

Council undertook a series of drop-in sessions where residents spoke with a Goulburn Mulwaree Councillor to better understand what the Special Rate Variation will mean to them.

Please click here to download a copy of the updated drop-in session schedule(PDF, 106KB)

Frequently Asked Questions

What is a Special Rate Variation (SRV)?

The Independent Pricing and Regulatory Tribunal (IPART) sets the amount Councils can increase rates by each year, which is called the rate peg. A special rate variation is a request by a Council to IPART to increase rates by more than the rate peg amount. A special rate variation can be for a single or multiple years. It can also be temporary or permanently retained in the rates base. To apply for a special rate variation Council needs to follow a process set out by IPART and formally apply for the variation and show how Council has met all of the criteria in the application guidelines.

Who is IPART?

The Independent Pricing and Regulatory Tribunal (IPART) is a NSW Government agency, that operates independently of the government to act as an independent pricing regulator for water, energy, public transport, and local government. Part of this role is to set the rate peg each year, and to assess any applications for special rate variations by Councils.

What is rate capping/rate pegging?

The Independent Pricing and Regulatory Tribunal (IPART) sets the amount Councils can increase rates by each year, which is called the rate peg, or rate cap. IPART’s rate peg considers the annual change in the Local Government Cost Index (LGCI), which measures the average costs faced by NSW councils, in additional to a population factor based on each council’s population growth. The rate peg is the maximum percentage amount by which a council may increase its general income for the year.

How does Council work out what rates to charge each resident?

Council does not look at individual rate accounts to work out how much to charge each resident. It looks at rating categories e.g. Residential, Farmland, Business, it then look at sub categories e.g. where the rate payer is located Goulburn, Marulan, within the Town Centre etc.

The rates are calculated using a base and ad valorem amount. The base amount is a set amount that may differ from category to category and forms part of the rates levied on each rateable property.

The remainder of the rates is calculated using the ad valorem which is a rate in the dollar amount multiplied by the land value provided by valuer generals.

What is ad valorem?

(1) The ad valorem amount of a rate is an amount in the dollar determined for a specified year by the council and expressed to apply--

(a) in the case of an ordinary rate--to the land value of all rateable land in the council's area within the category or sub-category of the ordinary rate, or

(b) in the case of a special rate--to the land value of all rateable land in the council's area or such of that rateable land as is specified by the council in accordance with section 538.

(2) The ad valorem amount of a rate is to be levied on the land value of rateable land, except as provided by this or any other Act.

(3) An ad valorem amount specified for a parcel of land may not differ from an ad valorem amount specified for any other parcel of land within the same category or subcategory unless--

(a) the land values of the parcels were last determined by reference to different base dates, and

(b) the Minister approves the different ad valorem amounts.

What is the annual operational budget for the Goulburn Mulwaree Council?

Council’s Annual Operational budget for 2023/24 is $105m.

How did we get here?

Under the rate peg set by the State Government, Goulburn Mulwaree Council is delivering infrastructure and services to meet the demands of a growing population. This has, however, become increasingly challenging in recent years. A truly volatile inflationary environment, the COVID pandemic, and recent weather events have increased Council's costs faster than revenue growth, causing extreme budgetary pressure. Costs are out-stripping revenue, resulting in Operating Deficits. Council has used cash reserves and reduced infrastructure renewal and maintenance to ensure balanced budgets, and sourced other income opportunities. Goulburn Mulwaree Council’s (‘Council’) Long-Term Financial Plan (LTFP), adopted in November 2022 indicated the need for Council to consider a permanent special rate variation (SRV) to ensure its ongoing financial sustainability. Council has now committed to exploring the option of an SRV application.

Has Council applied for a SRV before?

No. Council is one of the very few local government areas in the state to have never applied for an SRV.

Where we are up to in the process?

At the Council Meeting held on Tuesday 21 November 2023, Councillors discussed the matter of applying for a Special Rate Variation (SRV). After careful consideration and deliberation, Council endorsed the decision to proceed with its application.

Council will now apply to the Independent Pricing and Regulatory Tribunal (IPART) for a SRV with a permanent rate increase to be phased in over a three-year period as follows:

- 22.50% in 2024/25 (including the rate peg)

- 16.0% in 2025/26 (including the rate peg)

- 6.4% in 2026/27 (rate peg is not applicable)

This endorsement signifies Council’s support for pursuing the SRV to address the specific needs and requirements of our region now and into the future.

Council also endorsed additional provisions for its Hardship Policy and the Pensioner Concession Policy.

What is being proposed?

Council voted to take 2 special rate variation options to the community, plus the status quo, or base case which relies on the rate peg set by IPART each year.

What will change on my rates notice?

The SRV applies to the general rate charge. This is the base rate and land value (or ad valorem) charge on your rates notice. It does not apply to garbage or general waste, sewerage, stormwater, or water charges.

The impact on an individual’s rates will be different depending on the unimproved land value of their property.

How do our rates compare with similar Councils?

The Office of Local Government groups similar Councils for comparison purposes. Goulburn Mulwaree Council is in Group 4 with 25 other Regional Town or City Councils. This group of Councils represents a diverse cross section of geographies and communities across New South Wales, including Albury, Dubbo, Bathurst, Orange and Queanbeyan-Palerang, as well as coastal Councils including Byron, Ballina and Eurobodalla.

What other Council's have applied to IPART for an SRV in 2023-24

IPART has now assessed the 17 special variation applications in accordance with the Office of Local Government guidelines. Based on compliance with the required criteria, the Tribunal has fully approved 14 of the applications received earlier this year. 3 applications were only partially approved.

To view the full list please click here.

I already paid Council Development Contributions as part of my DA approval, how is this different?

When you develop you are contributing to the growth of the Local Government Area. This growth places demand on existing facilities and services and also creates demand for new facilities and services.

The levies that Council collect from developers are informed by Council's Local Infrastructure Contribution Plan 2021. This plan identifies the a number of services and capital projects that will be either funded or partially funded from contributions. These include new roundabouts, street lighting, intersection upgrades, cycleways and improvements to facilities such as Riverside Park, plus much more.

A complete list of these projects can be found from page 62 in the following plan: https://www.goulburn.nsw.gov.au/files/sharedassets/public/strategic-planning/public-exhibition/gm-licp-2021-amendment-1-20-september-2022.pdf

If implemented will the Special Rate Variation be permanent

Yes. If the Special Rate Variation is implemented this will be a permanent increase to your rates.

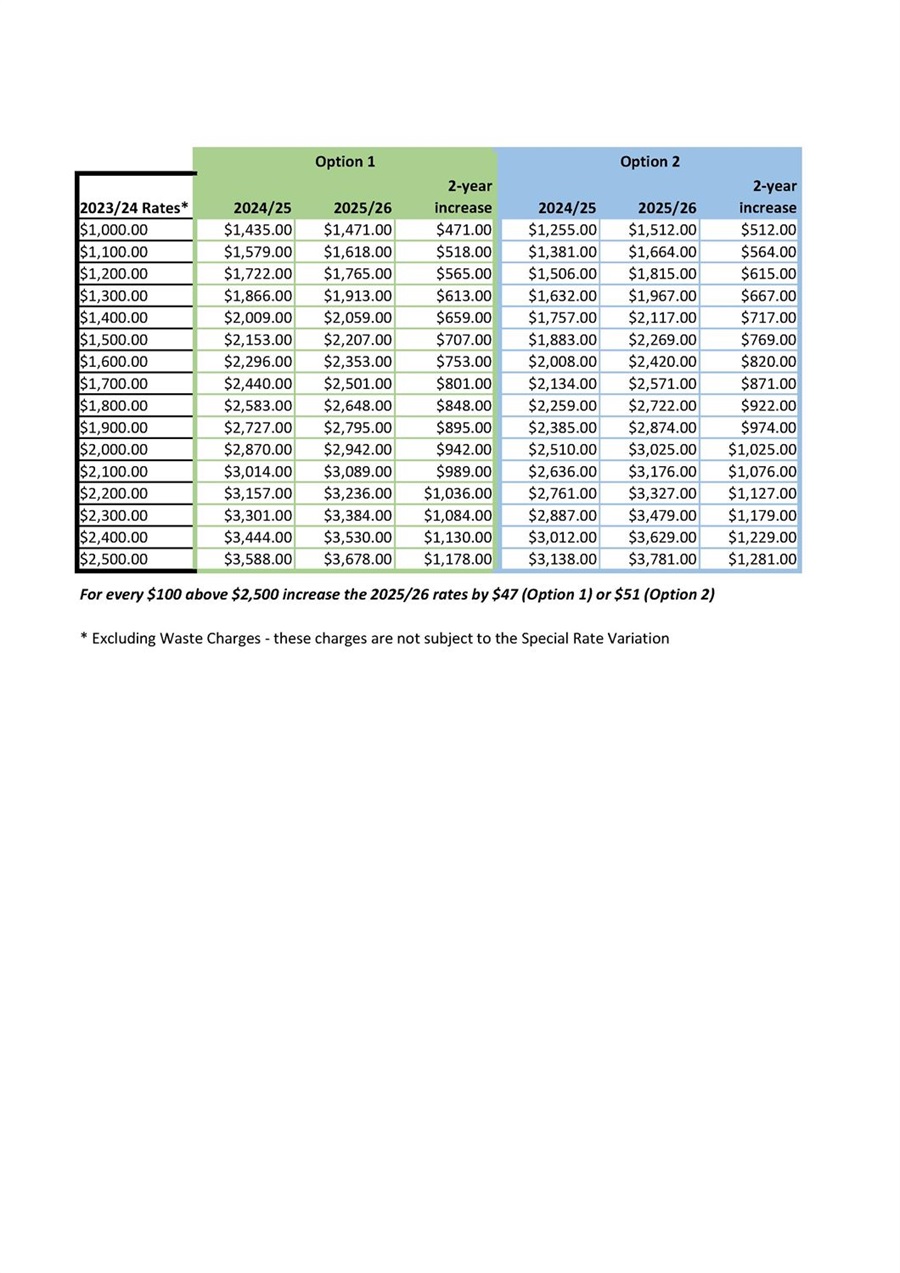

What will my rates be if the Special Rate Variation is adopted? Click through to our Ready Reckoner

The below table is examples of what your rates will look like if the SRV is adopted:

Submissions

Submissions have now closed.

(PDF, 38MB)